Some of the most recently built houses on the Dublin Road in Portlaoise.

The cost of buying a home in Laois has has risen by 8% according to the latest figures from Daft.ie.

The property website's House Price Report for the second quarter of 2024 shows that prices are 8% higher than a year previously, compared to a rise of 4% seen a year ago. The average price of a home is now €263,000, 7% below its Celtic Tiger peak.

From September 2023 to March 2024, the average cost of a newly built house was €400,000. Over this six month period, there have been 5,479 market transactions involving newly-built homes across the country.

The typical listed price for a house nationwide in the second quarter of 2024 was €340,398. This figure is 6.7% higher than this time last year, and 35% higher than at the onset of the Covid-19 pandemic.

The report attributes the continued inflation of costs to the shortage of homes in the country.

The quarter two breakdown for Laois from Daft.ie is as follows:

In June 2013, the average national asking price for a residential property was €97,500. In June 2024, this figure has risen to €201,000.

Across the country, the typical transaction price in the second quarter of 2024 was 3.5% above the listed price. A year ago, the gap nationally had been 1.1%.

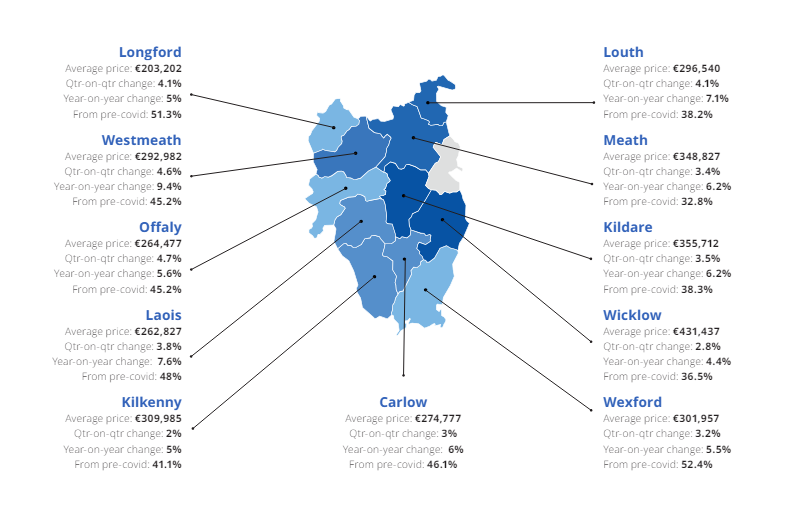

The report shows that while the increase in the second quarter was broadly based, there remain notable differences in price trends across the country.

In Dublin, prices in the second quarter of the year were 4.7% higher than a year previously.

In Cork and Waterford cities, the increase was closer to 10%.

Limerick and Galway saw prices more than 12% higher year-on-year.

By provinces, Munster had the highest increase at 10.4%.

Leinster (excluding Dublin) saw an increase of 6.1% year-on-year, while there was a growth of 6.2% in Connacht and Ulster.

While almost all regions saw inflation tick up, compared to previous quarters, in Connacht-Ulster inflation is cooling slightly.

More below image.

Since the start of the year, there have been consistently fewer second-hand homes available to buy, standing at 11,350 this June. This figure is down 18% year-on-year, less than half the 2015-2019 average of almost 25,000.

The only other time the market has been as tight, in a series extending back to 2007, is the period January-May 2022.

Daft says the fall in availability, which started in the middle of the year, can be seen in all major regions of the country.

Author Ronan Lyons, economist at Trinity College Dublin, commented on the key findings.

"economic conditions in the 2020s are very different from the 2010s," Mr Lyons said.

"The 2010s was a time of low inflation, low interest rates and – at least in the case of Ireland – relatively steady and strong economic growth.

Almost halfway through the 2020s, it seems clear that this decade will be characterised by much greater volatility as well as higher inflation and thus higher interest rates," he said.

"This was likely anyway before the invasion of Ukraine by Russia further affected the global economy but was inevitable after.

The tightness in availability has put upward pressure on housing prices. As the figures show, inflation had peaked in late 2021, as that glut of savings found its way into the housing market.

Inflation cooled from 13% in mid-2021 to just 2.6% in mid-2023. As of mid-2024, however, it is back to 6.7%. Where it goes next will depend on how fast second-hand supply recovers," Mr Lyons finished.

Subscribe or register today to discover more from DonegalLive.ie

Buy the e-paper of the Donegal Democrat, Donegal People's Press, Donegal Post and Inish Times here for instant access to Donegal's premier news titles.

Keep up with the latest news from Donegal with our daily newsletter featuring the most important stories of the day delivered to your inbox every evening at 5pm.