New three bed houses in Portlaoise on sale at €295,000.

Property prices in Laois have risen by €10,000 in the past year, with the lack of supply pushing up prices.

The median asking price for a property in the county is now €210,000, including the higher prices in Portlaoise and lower in more rural areas.

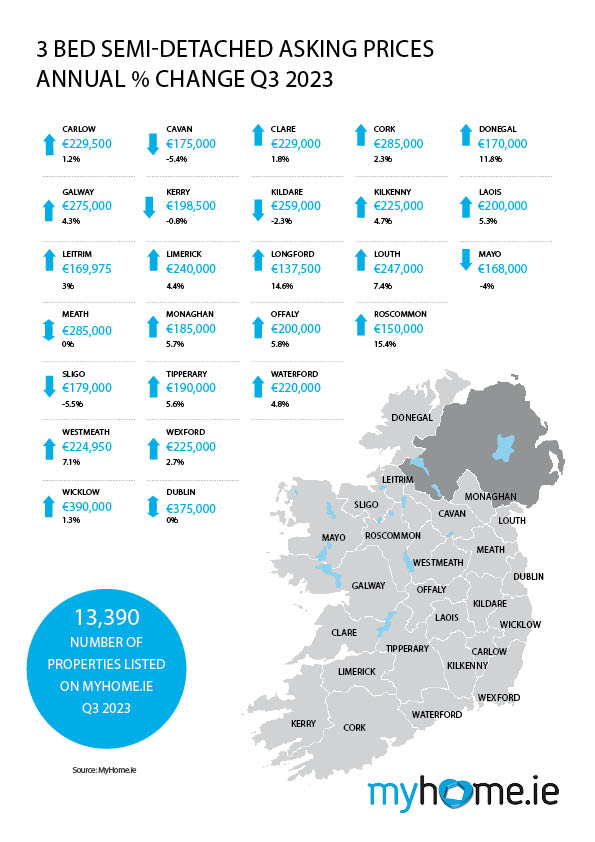

Asking prices for a 3-bed semi-detached house in the county rose marginally by €50 over the quarter to €200,000. This means that prices in the segment have risen by €10,000 compared to this time last year.

However in Portlaoise new 2-bed houses in estates are on sale for €295,000 as the town continues to attract more dwellers.

In Laois prices have risen by €15,000 compared with this time last year, according to the latest MyHome.ie Property Price Report.

Meanwhile, the asking price for a 4-bed semi-detached house in Laois is up by €20,000 compared to this time last year. The price fell by €2,000 over the quarter to €235,000 on average across the county.

There were 186 properties for sale in Laois at the end of Q3 2023 – a decrease of 3% over the quarter.

As October starts, there are 202 residential properties on the market in Laois.

The average time for a property to go sale agreed in the county after being placed up for sale now stands at just over two and a half months.

Nationally, houses prices are expected to rise further too.

The author of the report is Conall MacCoille, Chief Economist at Davy.

“The period of falling house prices we saw earlier in the year has come to an end, with the underlying imbalance between demand and supply providing fresh impetus to the market.”

He said that housing demand had remained resilient, despite interest rate hikes.

“That competition for homes is heating up is evident in the 3% premium over the asking price that buyers were prepared to pay in September, up from 1% at the beginning of the year. Furthermore, in July the average mortgage approval was €298,800, up 4% on the year, lending volumes up 18% on 2022.”

He said Ireland had avoided the house price declines seen in the UK and other countries for two reasons. “First off, the Irish economy has performed far better with employment already 12% above pre-pandemic level, an extraordinary pace of job creation. Hence, housing demand has remained robust. Second, the Irish housing market has been less liquid than other countries, so less vulnerable to the unexpected rise in ECB rates.

However, he noted that supply was still a major issue.

“The figures suggest any period of catch-up for housing activity following the Covid19 pandemic is now over. Worryingly, homebuyers may have to reconcile themselves to this tighter market.”

Mr MacCoille added that while Ireland saw 28,900 housing starts in the year to July, it needs 40,000-50,000 units annually to address our pent-up demand.

He said that, while affordability was stretched and the impact of past ECB interest rate hikes had yet to be fully felt, the surprise loosening of the Central Bank mortgage lending rules earlier this year would add fuel to house prices over time.

“We expect modest, low single-digit price rises from here, close to the pace of pay growth, so affordability is stable or improves marginally. However, this quarter’s MyHome report highlights the risk that the lack of housing supply could drive more aggressive price gains over the next one to two years.”

Joanne Geary is Managing Director of MyHome.ie.

“We know that there were just 13,400 homes listed for sale on MyHome.ie at the end of the third quarter, which is down from the pre-Covid figure of 20,000-plus. Even more striking is the marked decline in new listings on the website; there were just over 7,500 new listings during Q3, down a massive 38% compared with the same period last year.”

She said this lack of stock has had inevitably negative societal consequences.

“Recent CSO data shows us that the cohort of employed adults living with their parents has grown by 28% since 2016. Similarly, the average household size for those adults living with unrelated persons was now 3.72. This is unsustainable and will rightly be front of mind for the Government as it considers Budget 2024 next week.”

Subscribe or register today to discover more from DonegalLive.ie

Buy the e-paper of the Donegal Democrat, Donegal People's Press, Donegal Post and Inish Times here for instant access to Donegal's premier news titles.

Keep up with the latest news from Donegal with our daily newsletter featuring the most important stories of the day delivered to your inbox every evening at 5pm.